How does Payt work?

Payt is the most comprehensive software for credit management. With our cloud solution, you can automatically follow up on invoices, send reminders and warnings, and keep your customer interactions personal. More than 17,000 users utilise Payt daily. Millions of invoices are sent through our platform every month.

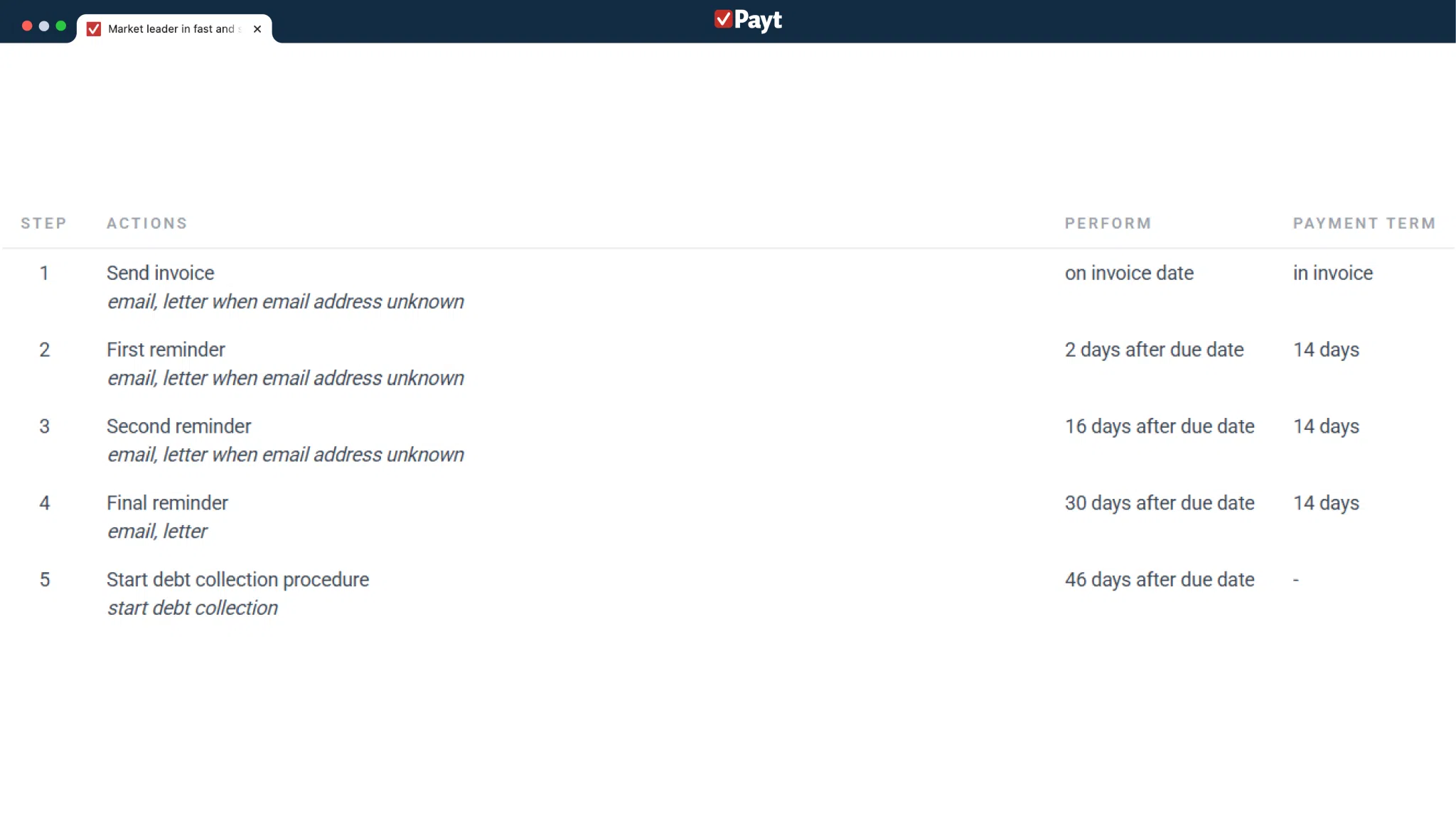

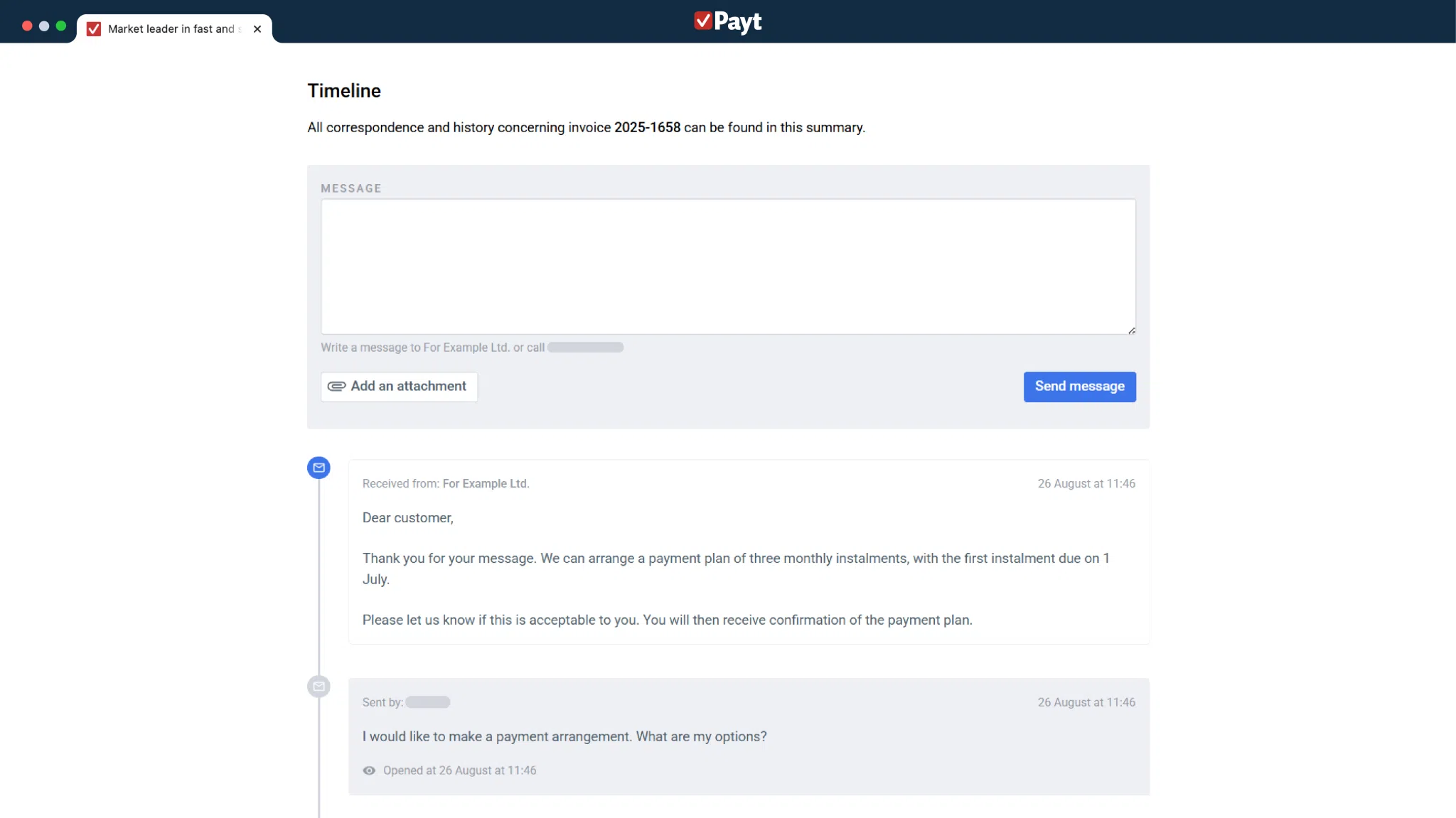

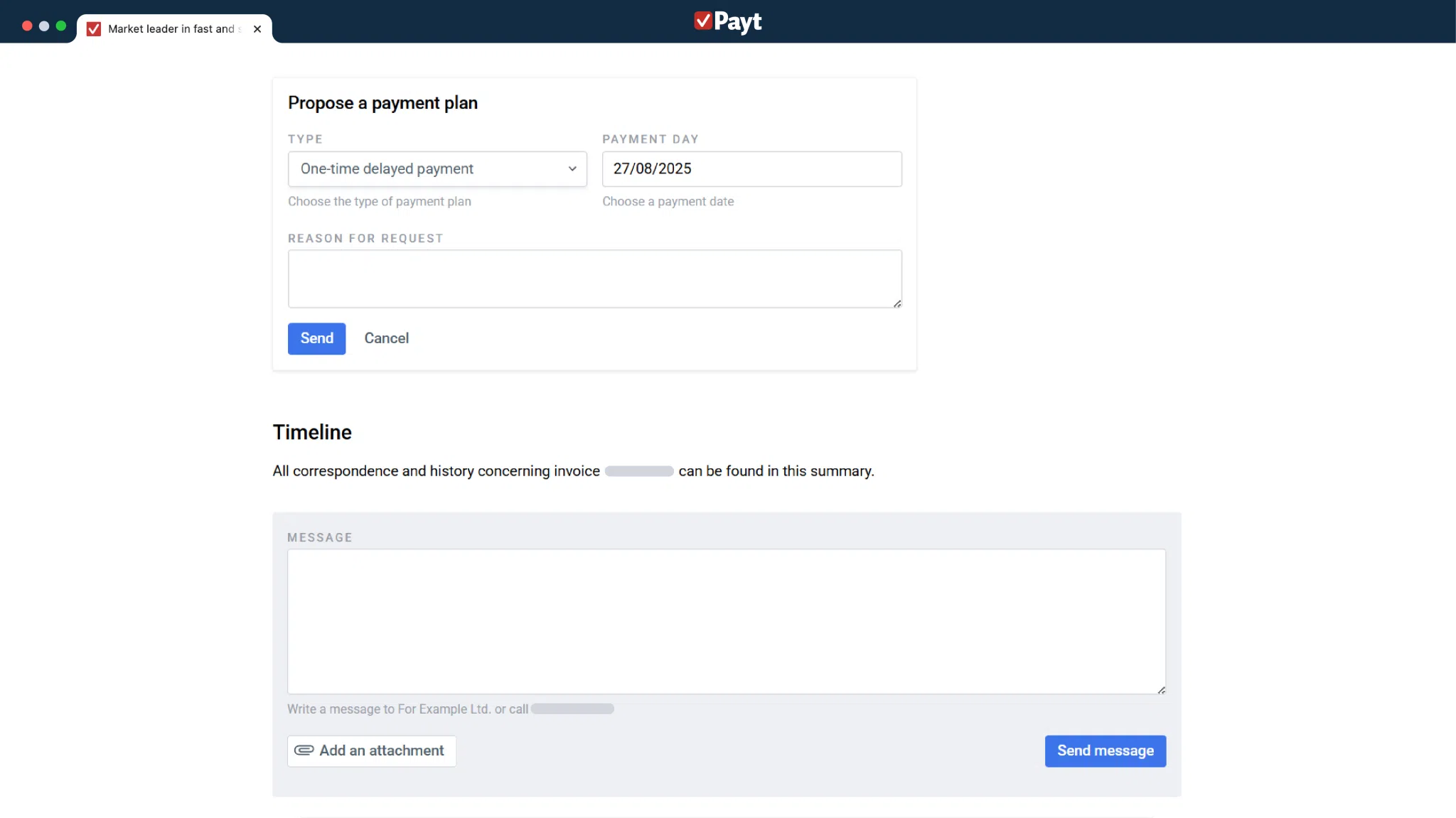

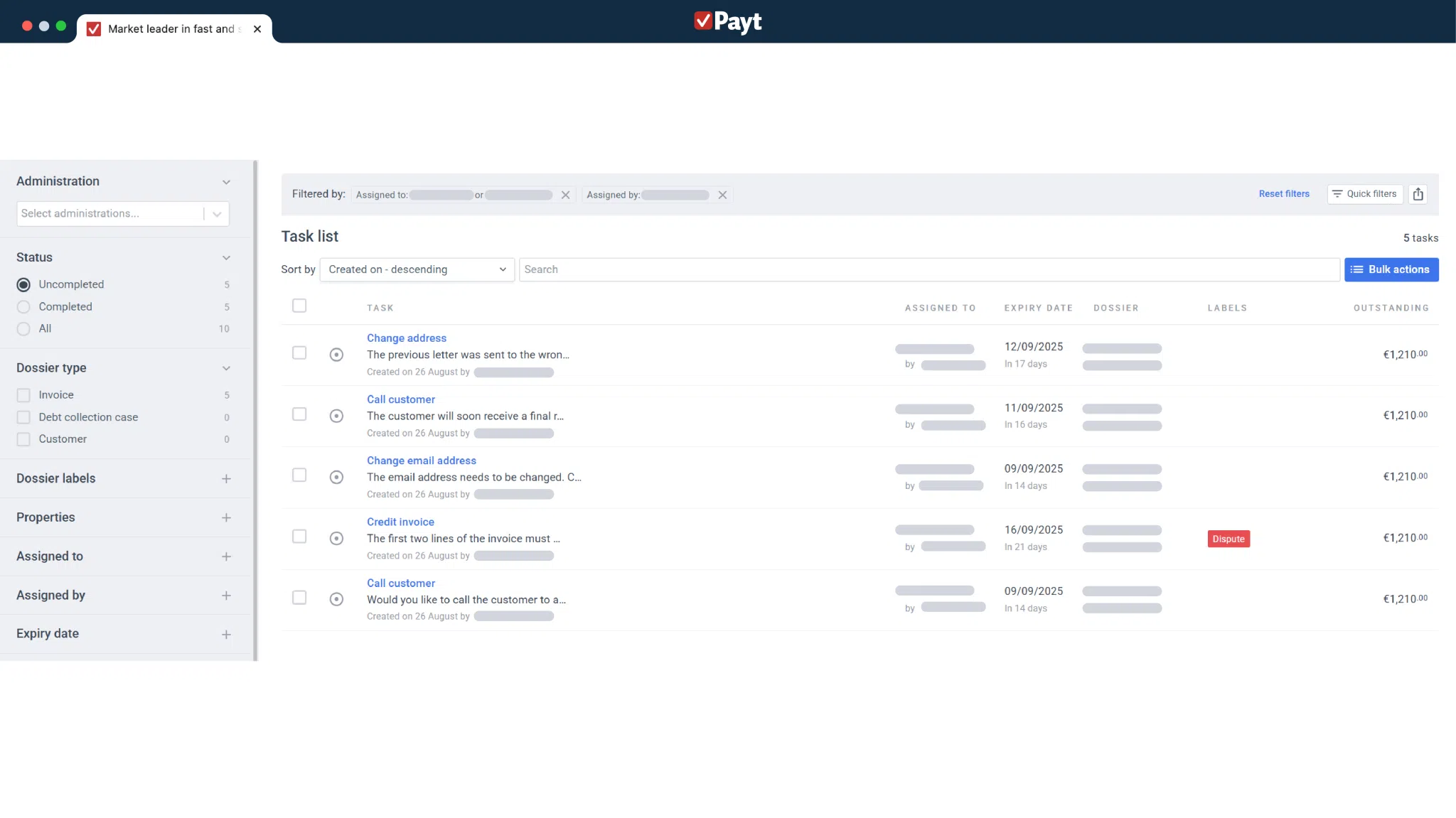

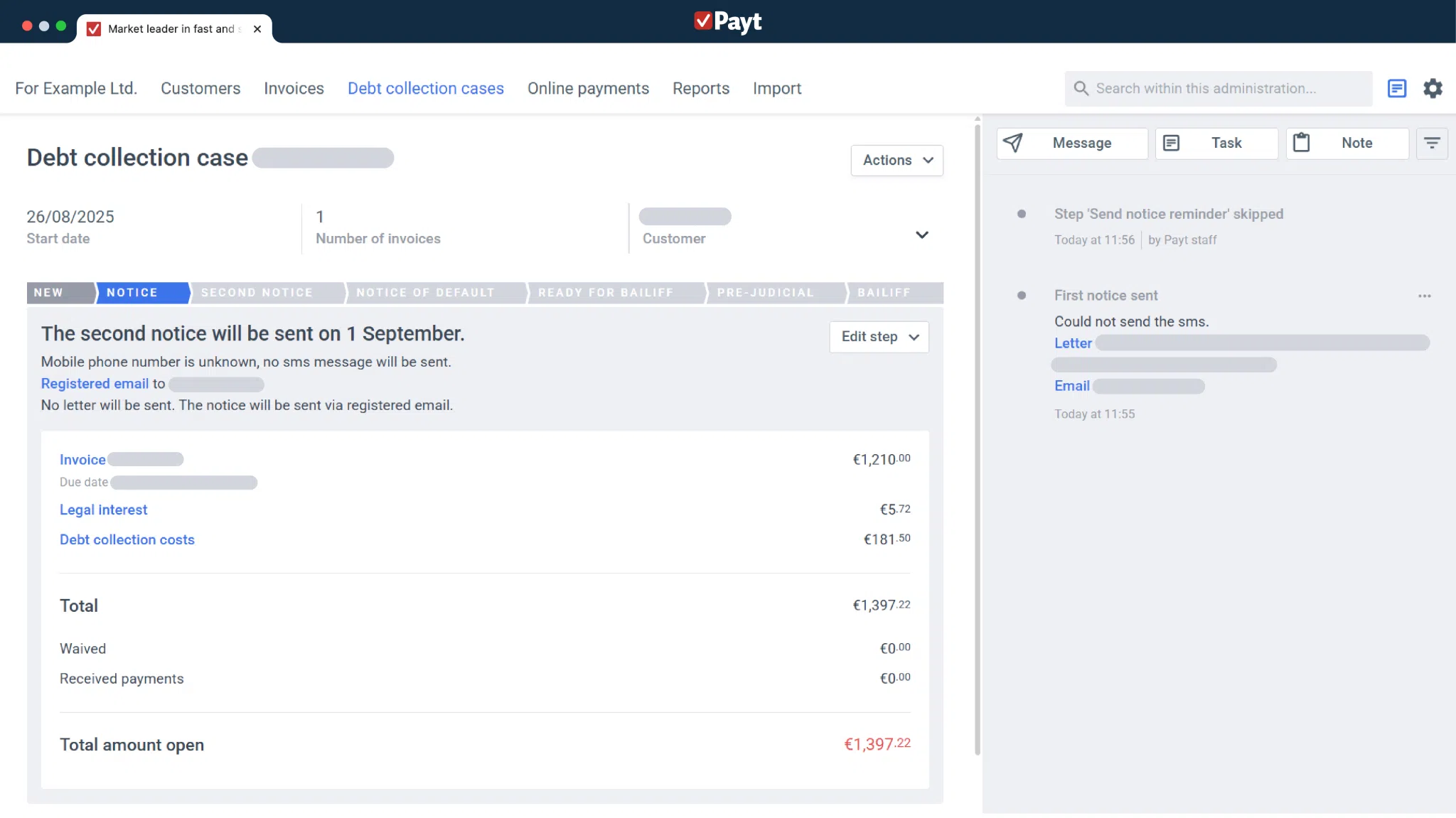

With Payt, you manage the entire credit management process in one system. No more separate tools or manual actions: everything is automatically followed up, while you maintain an overview.

On this page, we will cover the following points:

- What does Payt’s software do?

- Who is Payt intended for?

- What are the benefits of Payt?

- How does Payt work in practice?

- Schedule a demo now