As a business owner, understanding how to create an invoice is essential for keeping your records in order and ensuring timely payments. Whether you’ve just started as a sole trader or you’re running an established business, a well-prepared invoice supports a healthy cash flow and reinforces professionalism.

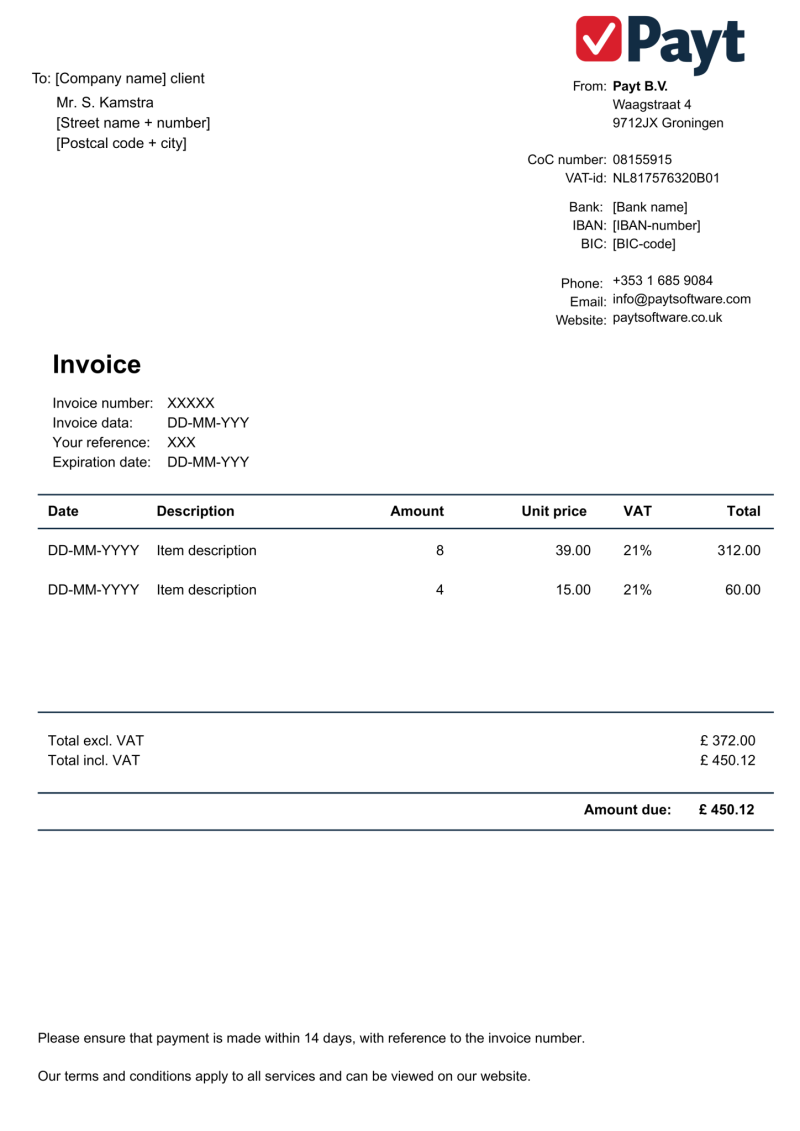

In this article, we’ll explain everything you need to know about how to create an invoice, with practical tips and a clear example.

Table of contents: