Why AI is the future of efficient credit management

At Payt, we have been actively experimenting with artificial intelligence (AI) for several years. But before diving into how we apply it, let’s first take a step back and share our vision for the future of credit management combined with AI.

Imagine an AI worker – let’s call him Payter – who, in the near future, operates as the smartest employee you could wish for. With flawless, learnable communication skills and no limits to what you can teach him. Payter thinks faster than we do, works tirelessly without breaks, and never falls ill.

The latest generation of AI workers can even pursue goals independently and learn how best to achieve them. That makes AI incredibly powerful, but also vulnerable: if AI makes a mistake, it can do so just as convincingly as when it gets things right. This phenomenon is known as “hallucination.” That’s why a strong feedback loop – where AI continually learns and is adjusted – is crucial to ensure reliable results.

At the same time, we are all witnessing the growing pressure on the labour market. The workforce for the next 25 years has already been born, meaning the number of working people will continue to decline. This presents a major challenge. And let’s be honest: very few people genuinely enjoy chasing unpaid invoices. That’s exactly where AI offers an excellent solution.

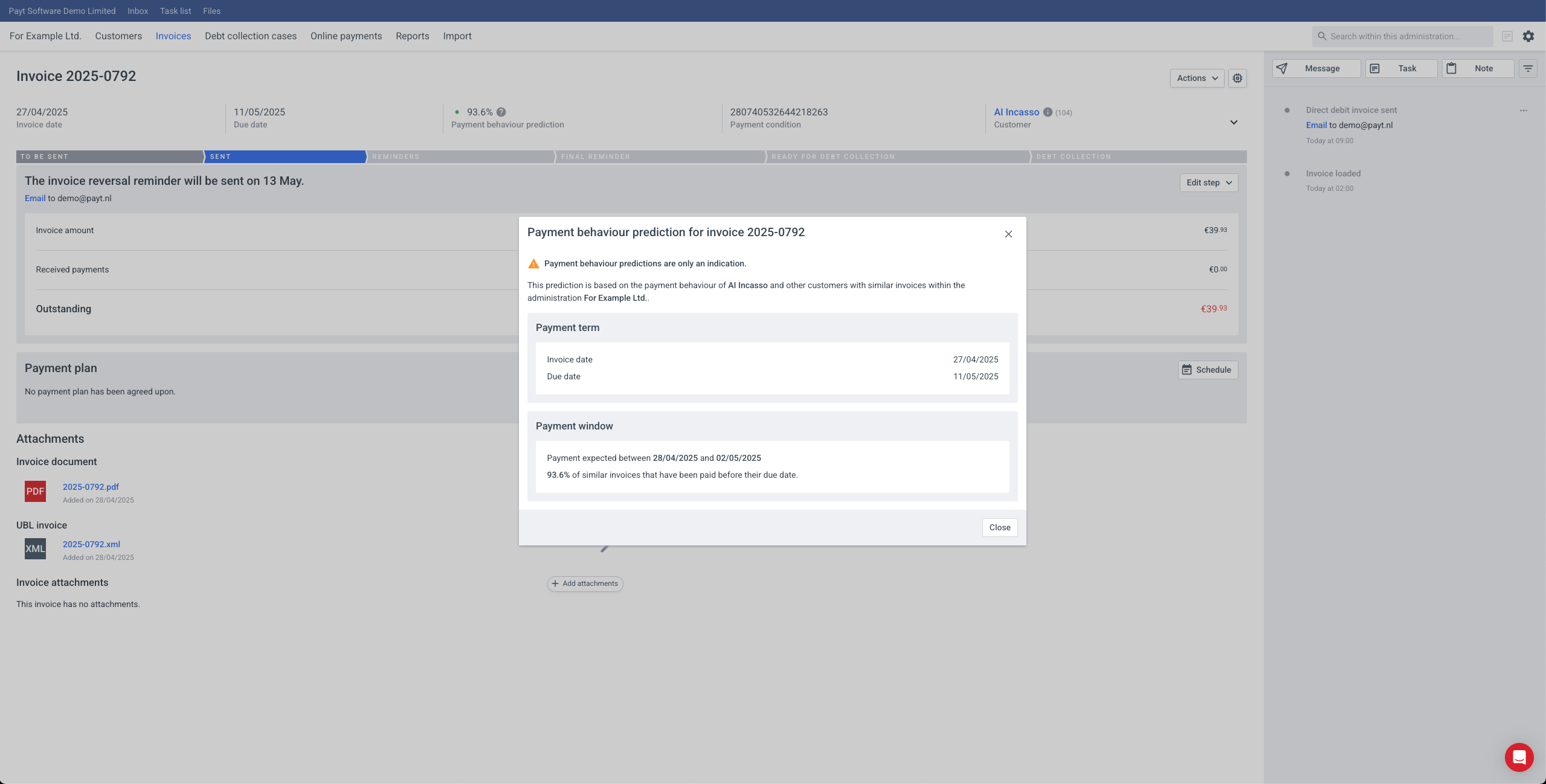

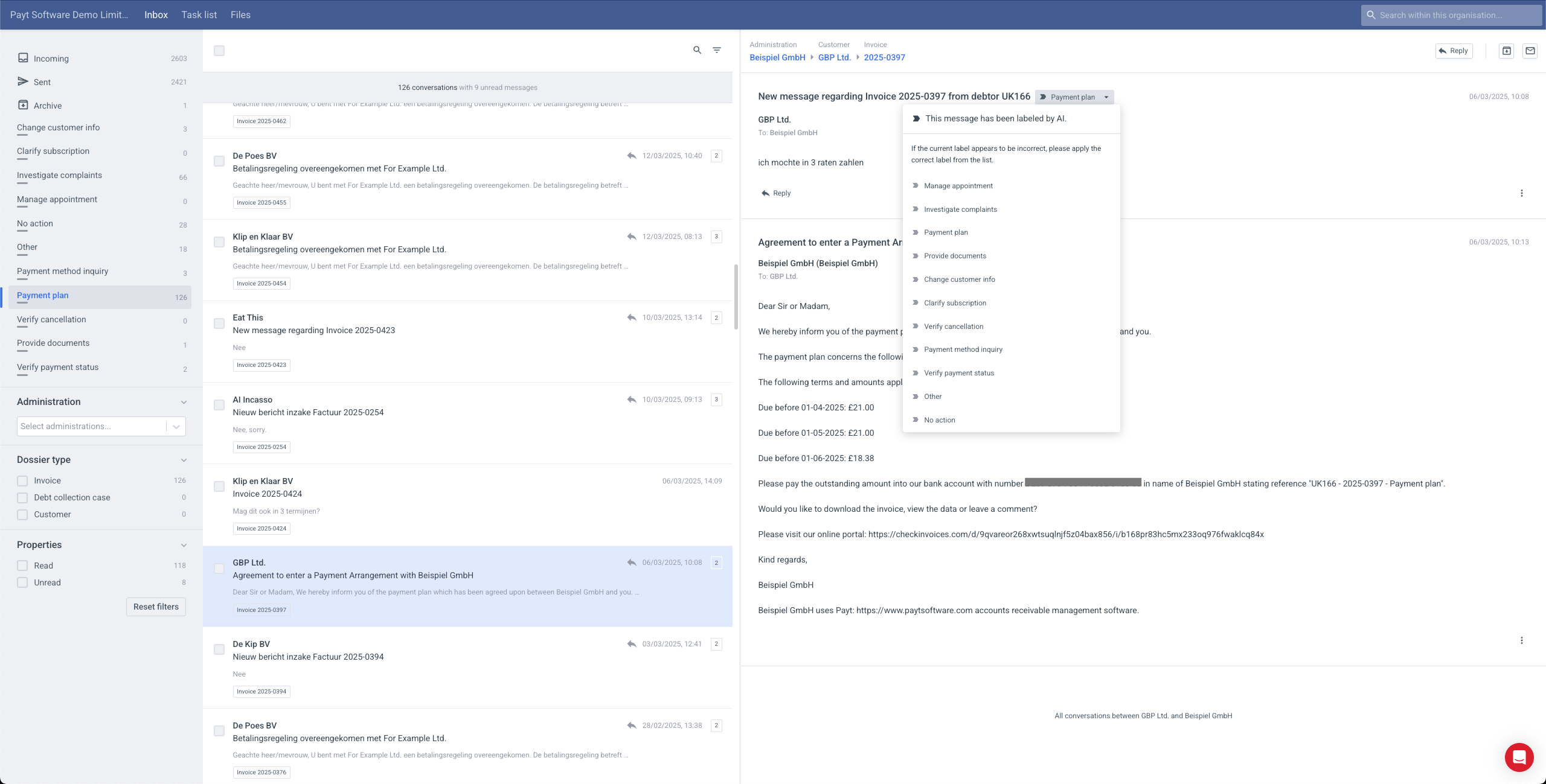

In this article, I will show you how Payt is already using AI today to make credit management smarter, faster, and more personal.