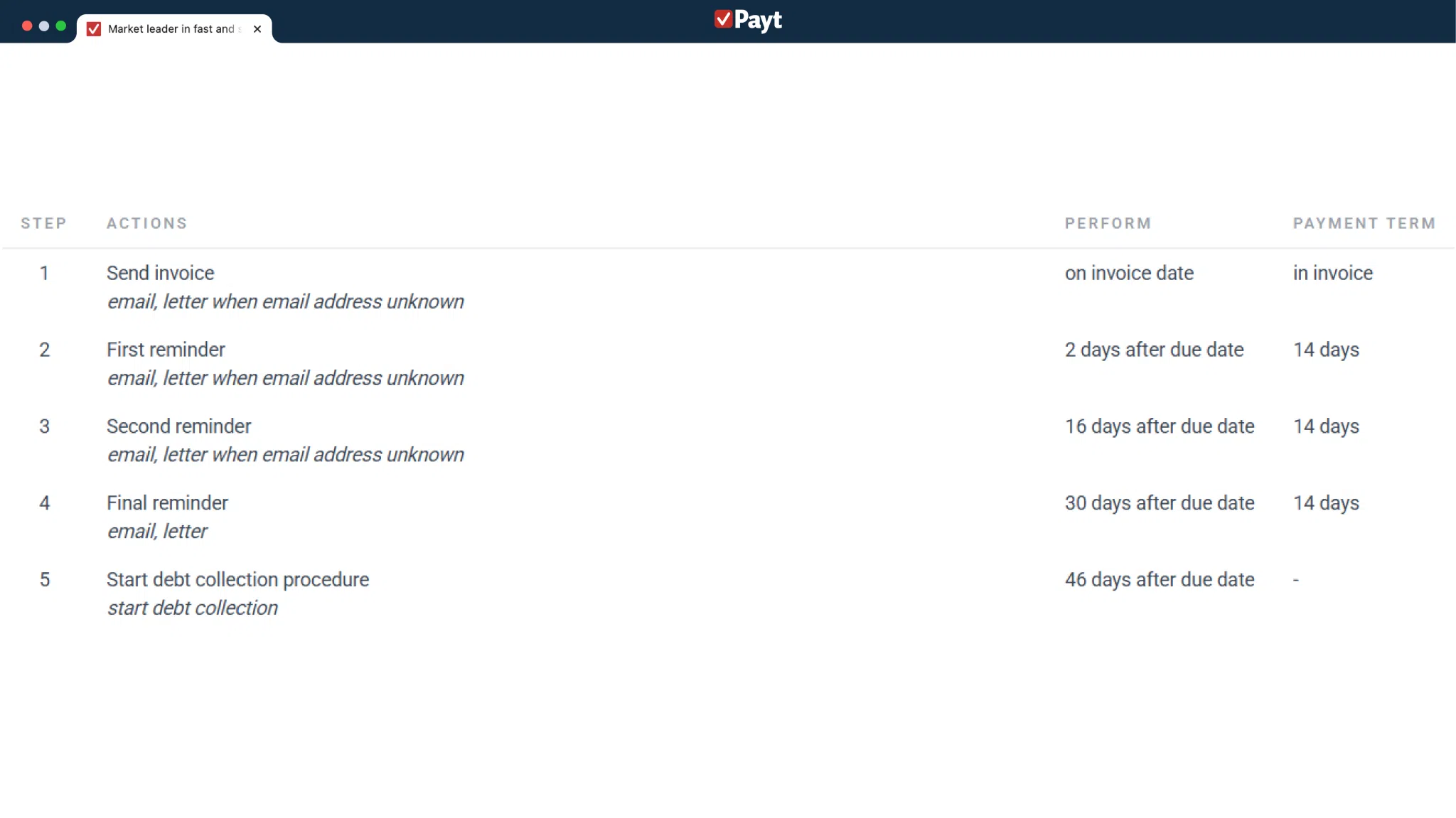

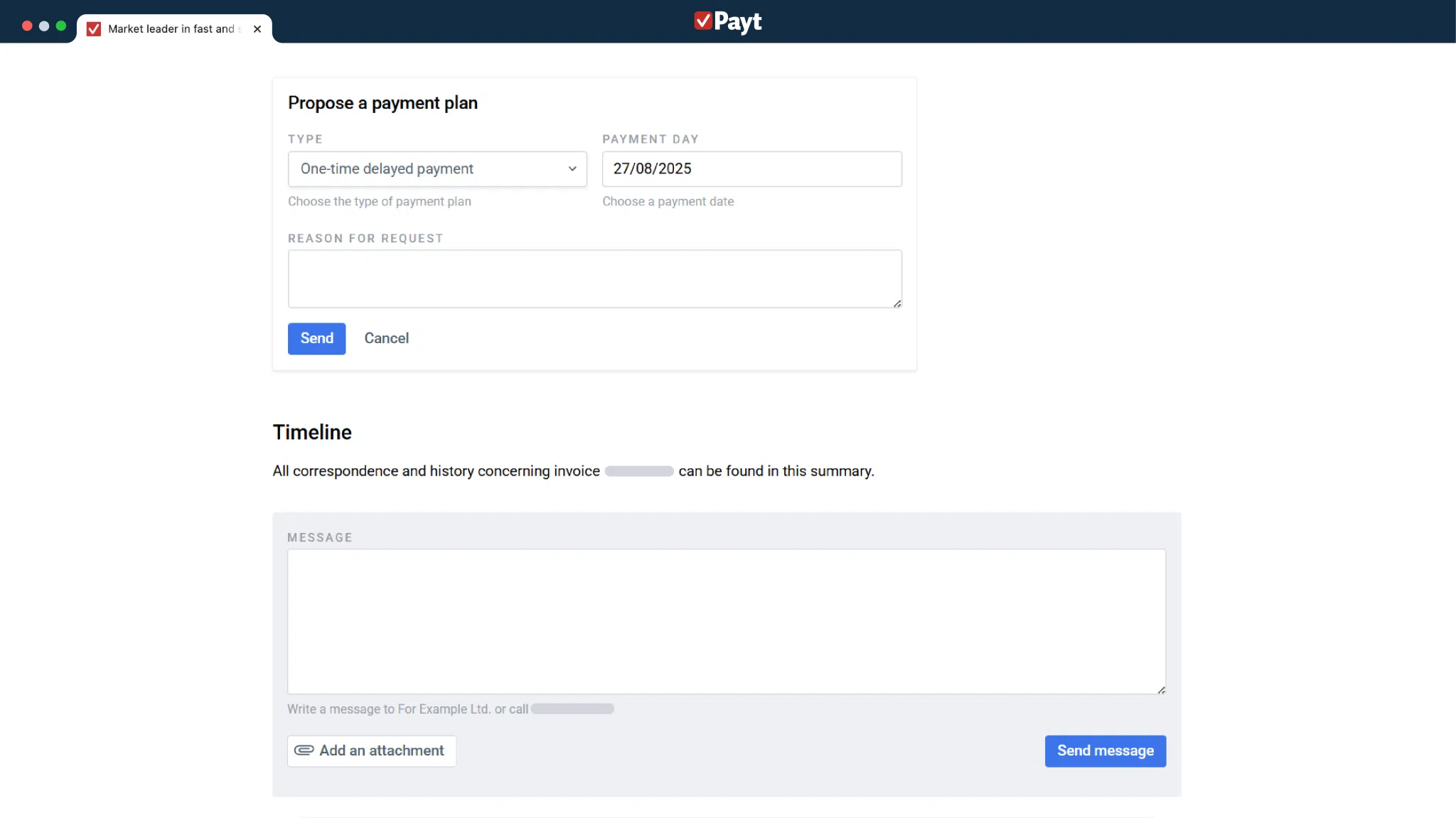

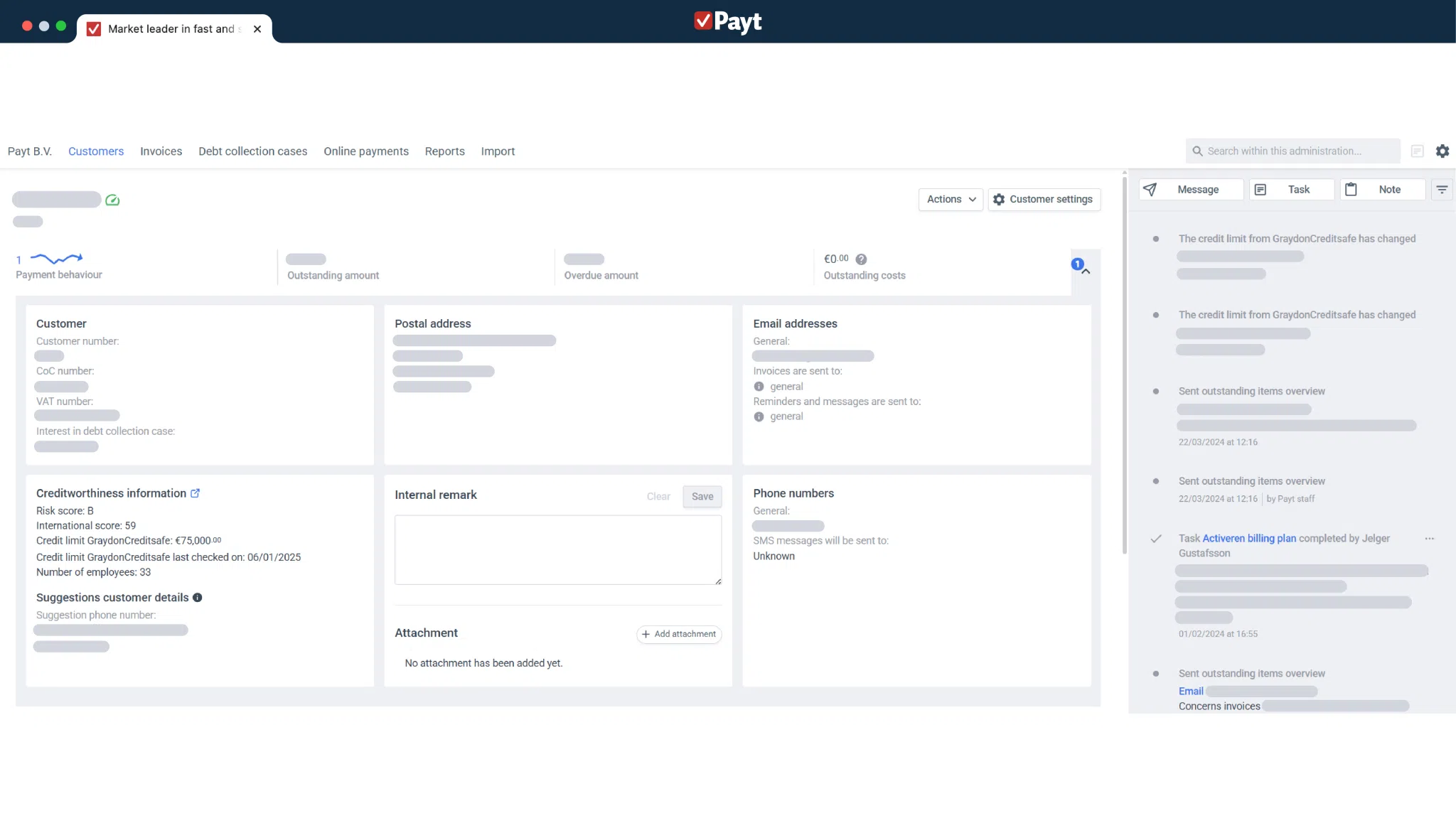

Credit management software is a digital solution that helps businesses manage and optimise their credit control process. With this software, you gain clear visibility of outstanding invoices, automate payment follow-ups, and reduce the risk of bad debt. The goal is simple: get paid faster, improve communication with customers, and maintain control over your cash flow.

In this article, you’ll discover exactly what credit management software is, how it works, the key features it offers, and how it can quickly improve your liquidity.

Table of contents: